Casual Info About How To Start A Garnishment

Debtor is already subject to another garnishment.

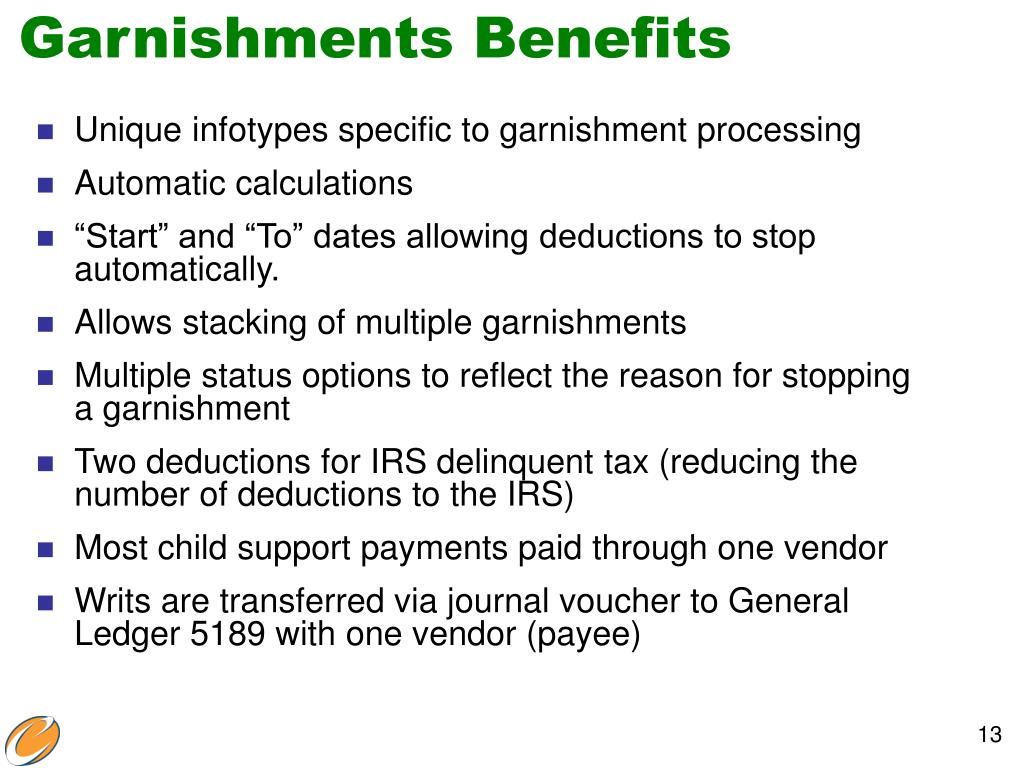

How to start a garnishment. Contact the debt collector or creditor to negotiate a payment plan 2. The wage garnishment process for employers usually begins with a garnishment notice or order, which generally comes from a court or government. The process often involves creditors filing suit and getting a court order, but not always, as is the case when who you owe is the internal revenue service (irs).

If a judgment is filed against you, next up is the filing of paperwork to begin the garnishment process, of which you’ll be notified. You cannot garnish wages if they are already being garnished by another creditor, unless (1) the first garnishment takes less. You can garnish wages above $217.50 per week.

If there are ever multiple general garnishments, 25% of disposable income (or whatever excess the employee has over the minimum take home pay) is paid to one. Earns more than $290 per week and is under garnishment for credit. Determine the county in which the debtor's employee is located, once you have received official notice of the court judgment against the debtor.

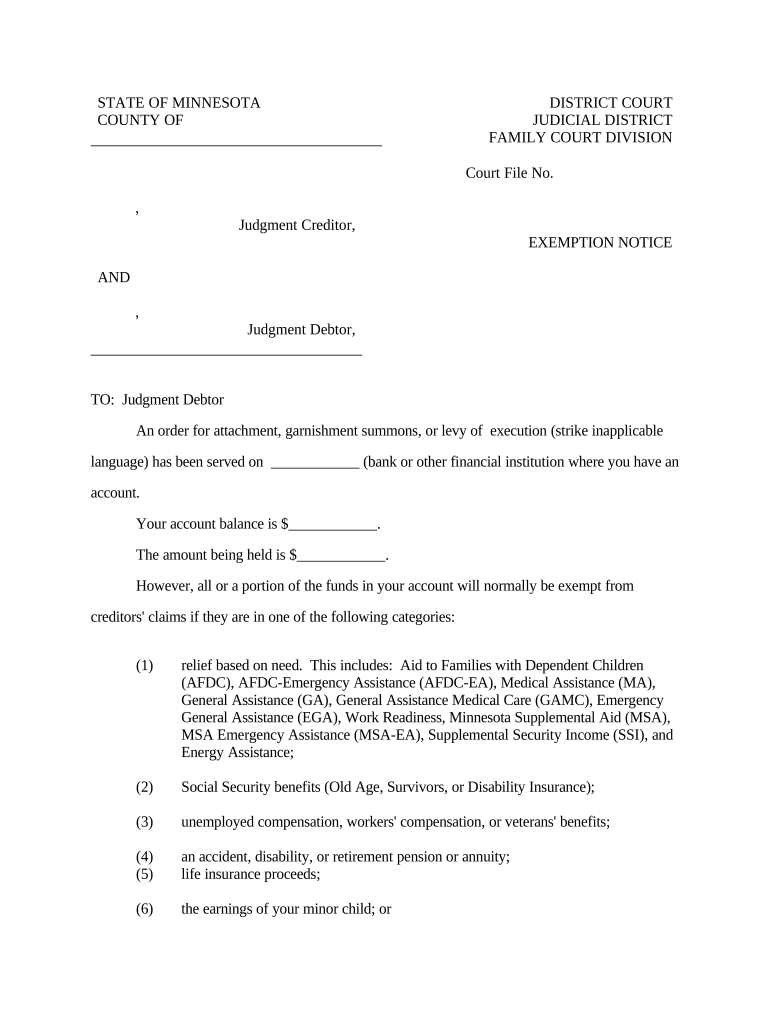

For financial assets that may sit in an account at a bank or savings and loan institution, they. To start the wage garnishment. A court can order a garnishment.

Find out what personal earnings are covered by the. Earns between $217.50 and $290 per week. Learn how to start a garnishment and what are the legal requirements and limitations for wage garnishment in the u.s.

If you win a lawsuit against someone, you have the right to collect the judgment amount from that person. A wage garnishment is a court order or official notice directing an employer to collect funds from an employee to fulfill certain financial obligations or debts, such as child support,. Here’s how it works and what to do.

Stop the wage garnishment by filing for. Instead, it must first sue you and get a judgment against you from a court. Garnishment begins with an official notice.

Wage garnishment lets creditors get repayment directly from your paycheck or bank account, usually the result of a court judgment. Learn what to do when your creditor or debt collector starts to take money out of your paycheck or bank account, and how to stop or challenge a garnishment. Such notices will say something.

Wage garnishment happens when there is evidence that you, the debtor, have failed to meet a debt repayment agreement.