The Secret Of Info About How To Obtain A Unique Tax Reference

What is the most effective method to get your utr number?

How to obtain a unique tax reference. If you haven’t done so already, register with hmrc online. To submit your tax return from the untied app, you will need to enter your utr number along with your government gateway id (but you can use untied express submit if you. Andrew jordan explains how to find and request a company utr (unique tax reference).if you have any questions or need any help please call us.

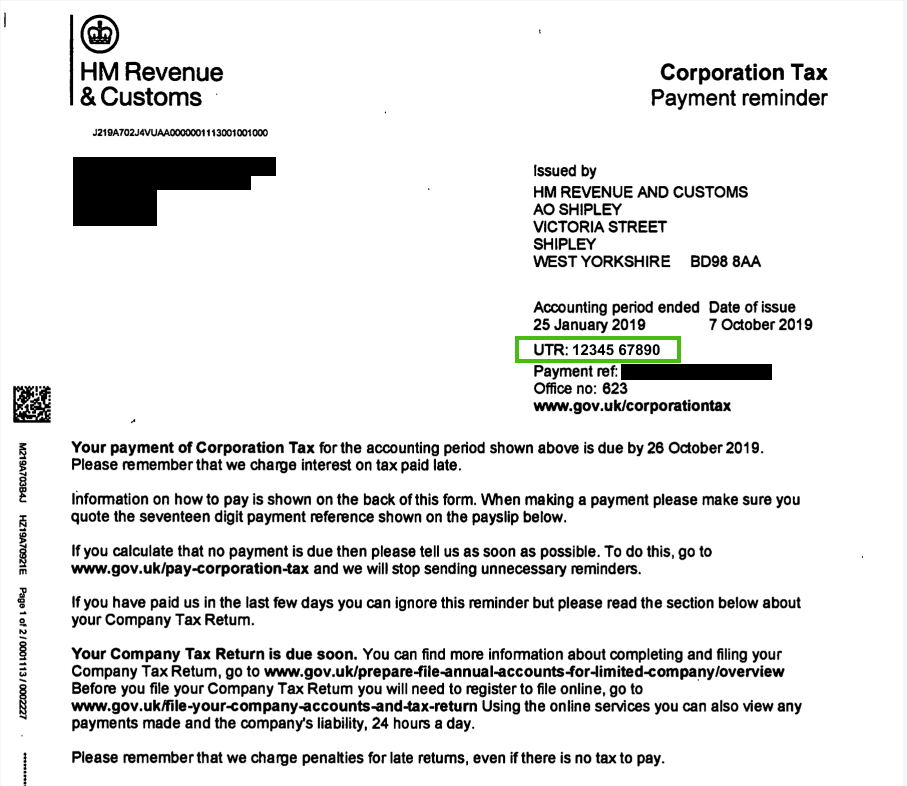

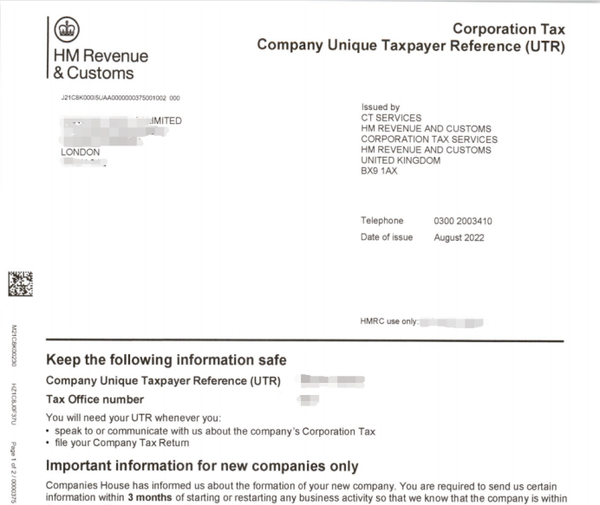

Here's how to do it: A unique taxpayer reference (utr) will then be issued by hmrc and delivered to your registered office address within a few days of company formation. However, rpos may collect other reference numbers such as a vat registration.

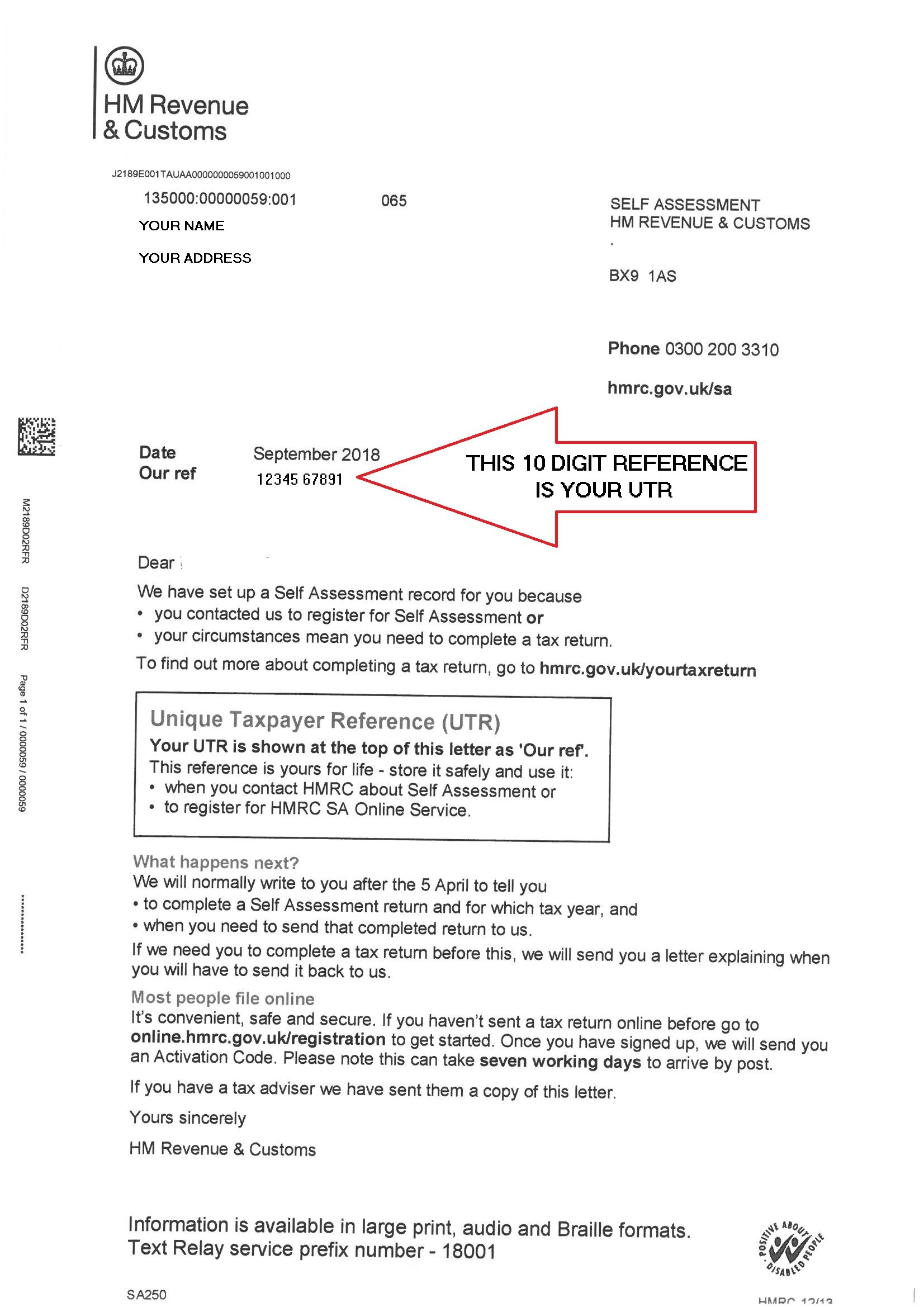

When you’re setting up a company, your unique taxpayer reference will be printed in letters from hmrc and may be referred to as a ‘tax reference’ or ‘unique tax. This can be done online through the official. How to get a unique taxpayer reference number (utr) now that we’ve covered how important it is, how do you get a utr number?

If you’re waiting for a unique taxpayer reference (utr), you can check when you can expect a reply from hmrc. This video shows you how to use the hmrc app to find your unique taxpayer reference number. Hmrc send you a utr number when you register for a self assessment tax return.

How to obtain your utr. You can find it in your personal tax account, the hmrc app or on tax returns and other documents from hmrc. You usually need to file a.

Utr stands for unique taxpayer reference. Rpos should not routinely ask sellers to provide a unique taxpayer reference (utr). You should check if you need to send a tax.

Go to hrmc's website or fill out the form online,. It might be called ‘reference’, ‘utr’ or ‘official use’.

![Find Your Personal UTR Number [2024]](https://assets-global.website-files.com/5d71eeb2a19ee03e3430f50f/618bbbd6e4373f581237eee7_UTR Number v2.png)