Perfect Tips About How To Obtain Last Years Agi

How do i get my agi if i don't have a prior year tax return?

How to obtain last years agi. How do i find last year's agi? Turbotax lets you log in and download your previous year returns you had filed through them. Nov 30, 2022 • knowledge.

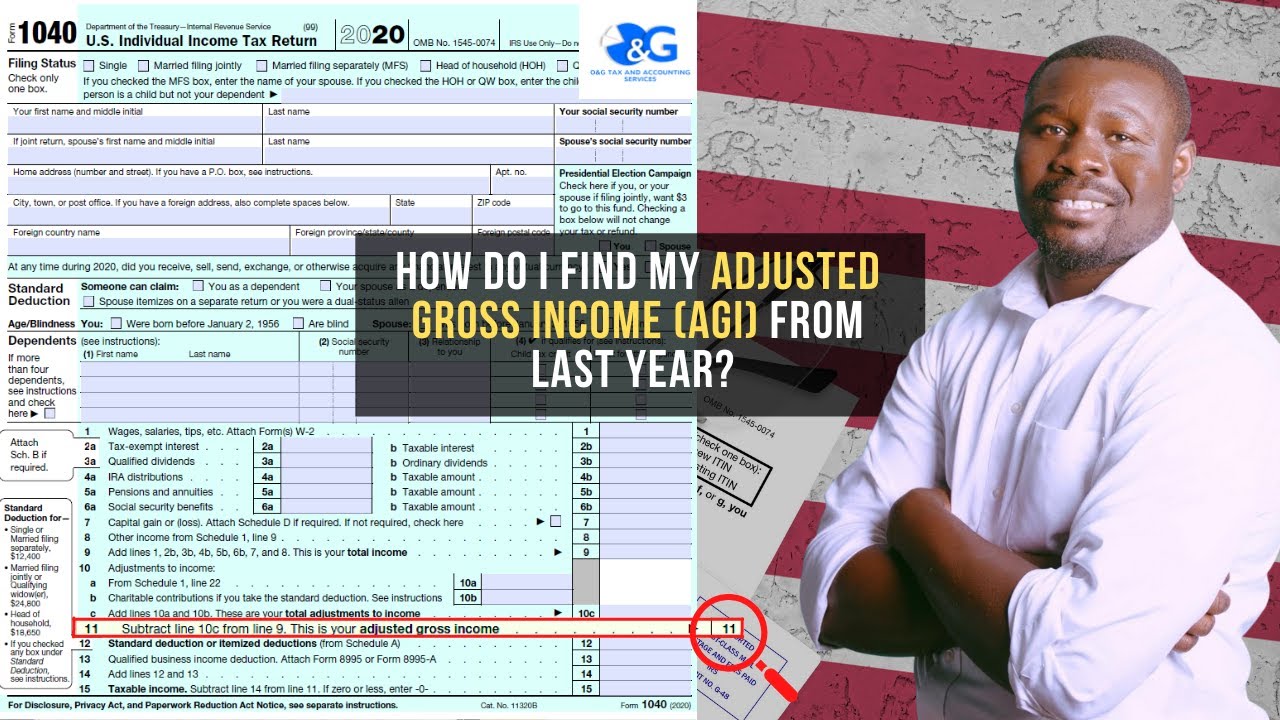

Your agi is entered on line 11 of form 1040, u.s. Learn how to find last year's agi using turbotax online by watching this helpful turbotax support video. Sign in to your taxact account.

How do i find last year's agi? Solved • by turbotax • duration 1:11 • 556 • updated 2 weeks ago. Click on the pdf icon for the tax year.

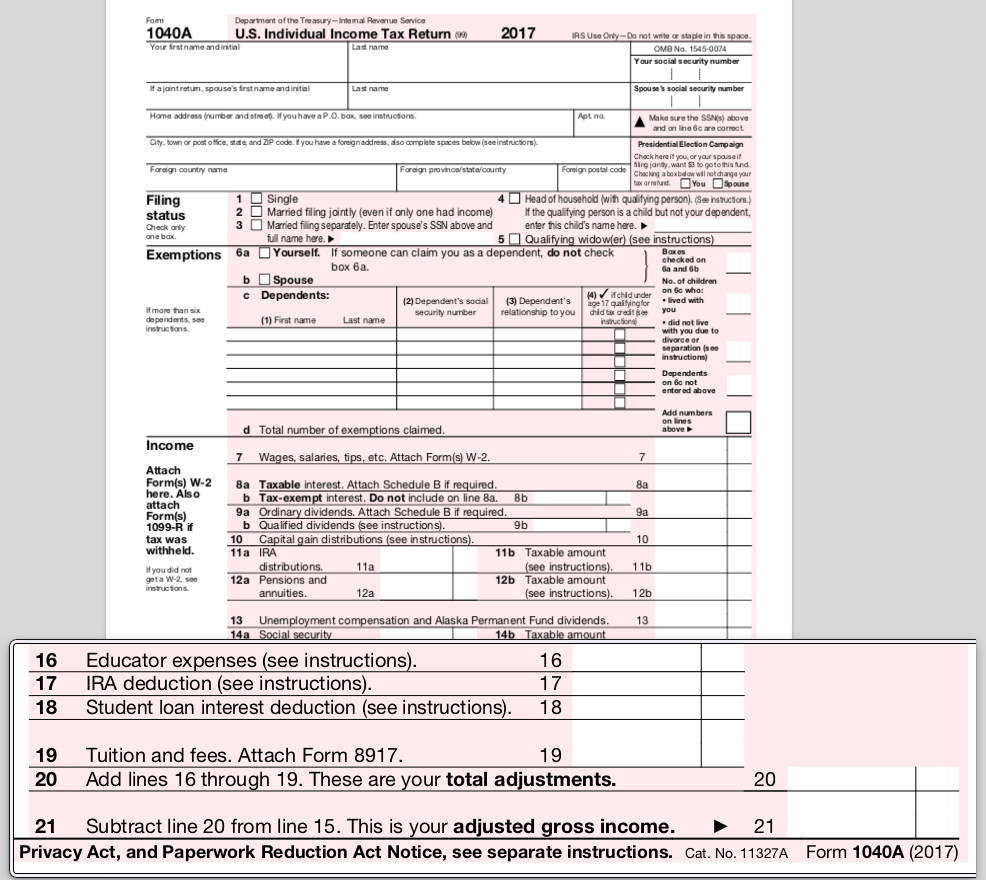

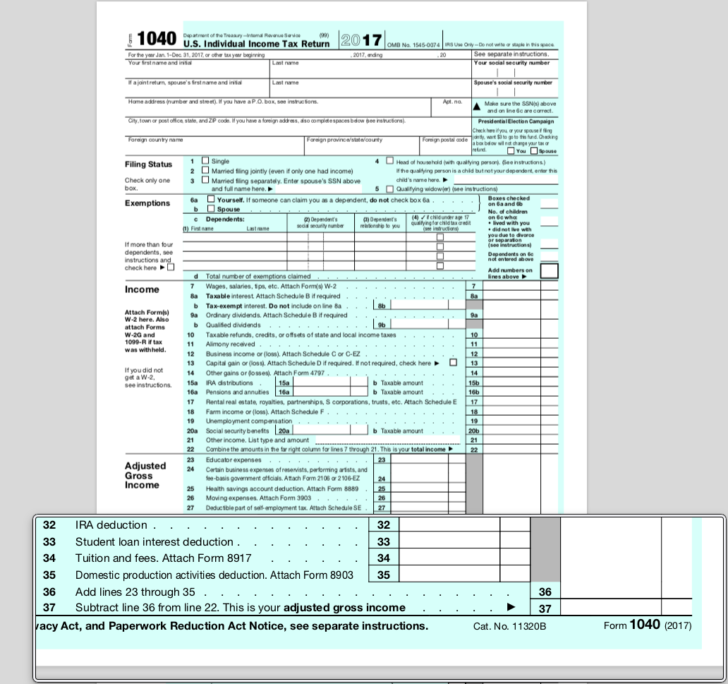

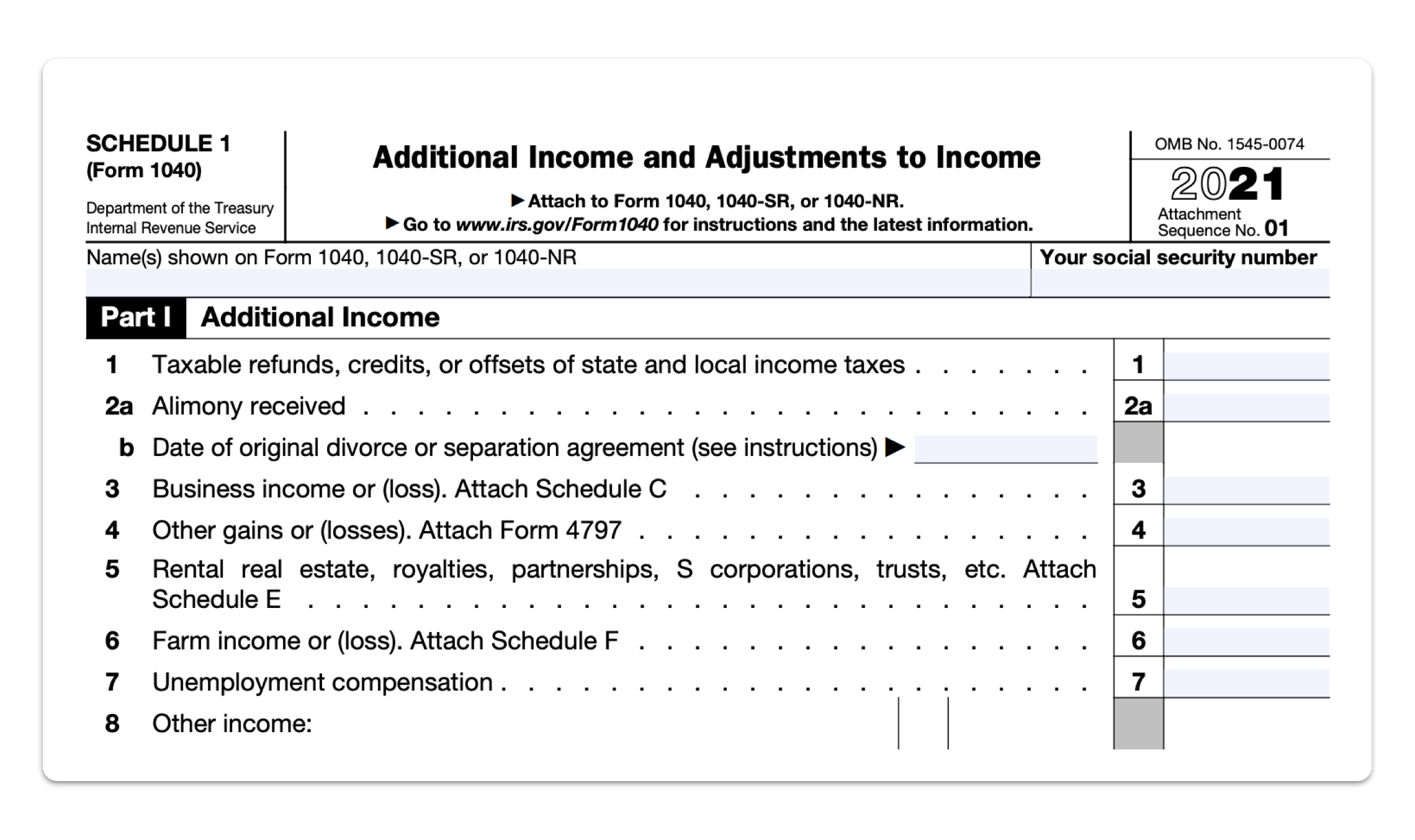

Some forms allow you to take more adjustments to income, than others. How to get your agi from last year. Here is where to find your prior year agi based on the income tax return you filed:

For those waiting on their 2022 tax return to be processed, enter $0 (zero dollars) for last year's agi to ensure the. Your may need your agi to. See your prior year adjusted gross income (agi) view other tax records;

How do i amend my federal tax return for. No views 1 minute ago. You can only file 1040ez if you’re single or married filing jointly,.

The agi calculation depends on the tax return form you use; Solved•by turbotax•2049•updated 1 month ago. To get your agi from last year, you’ll need to look at your previous year’s forms.

If you used taxact to file your return last year, you can retrieve your agi by following these steps: Visit or create your online account. If you don't have a prior year return to find your.

When it comes time to file your taxes, you have a couple of ways to locate your. The easiest way to get your previous year agi for the irs is to find your old tax return. Click on my account in the upper right menu.

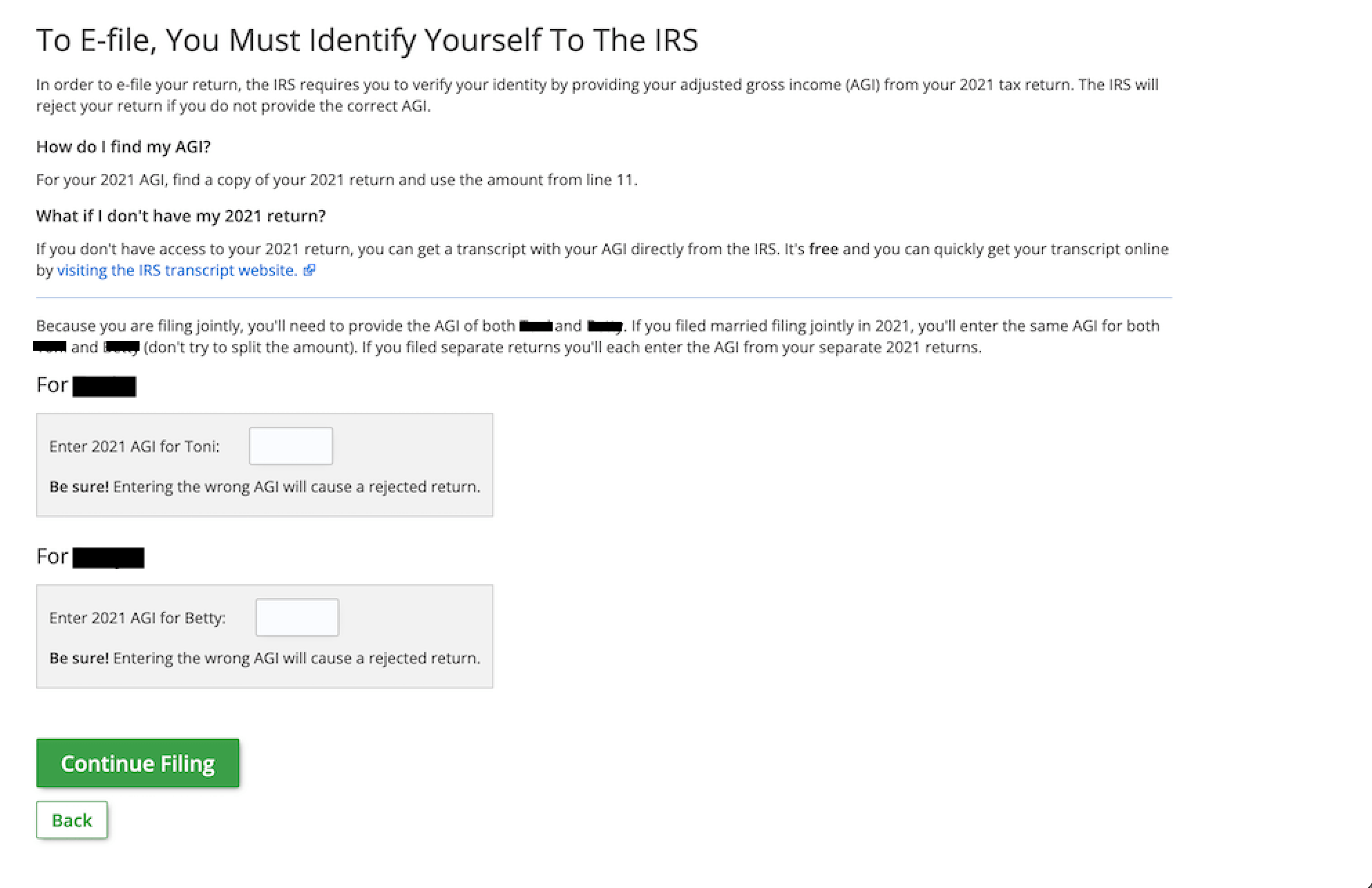

If you and your spouse filed jointly last year, your spouse’s. Confirm your identity to e. When you need your agi.