Marvelous Tips About How To Get A Power Of Attorney

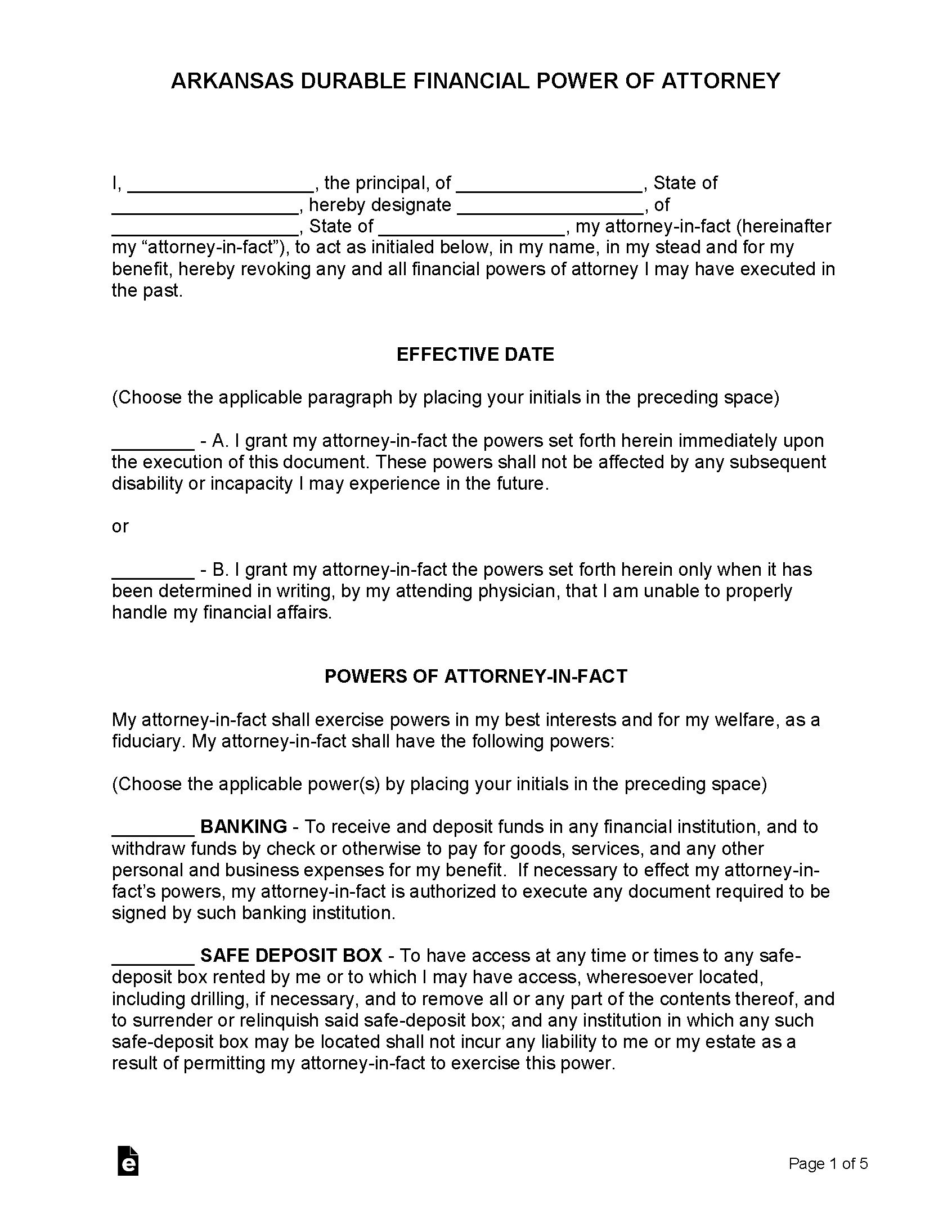

There are four main types of power of attorney:

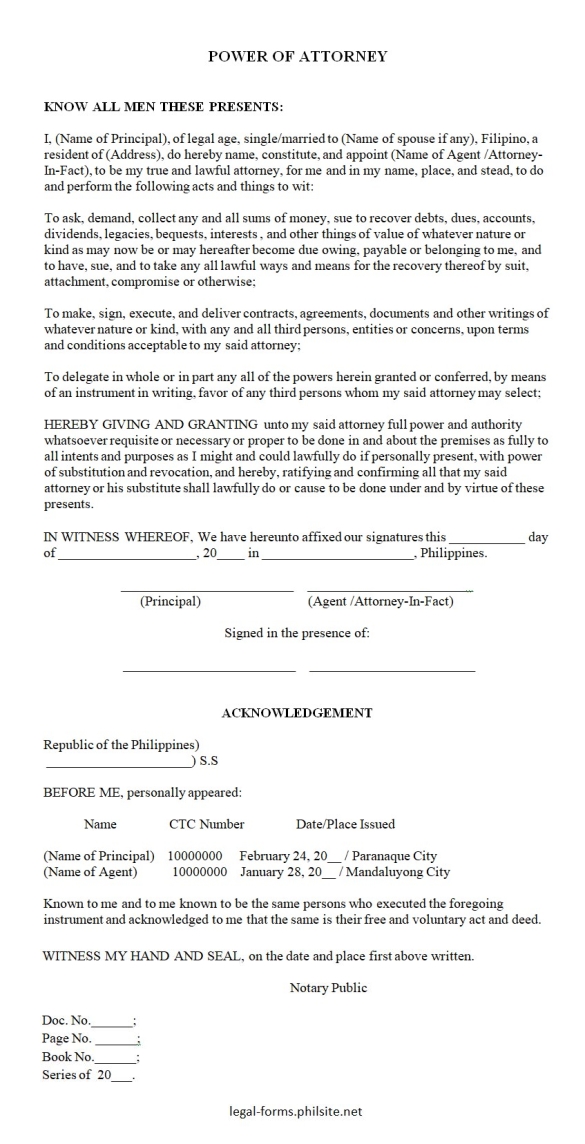

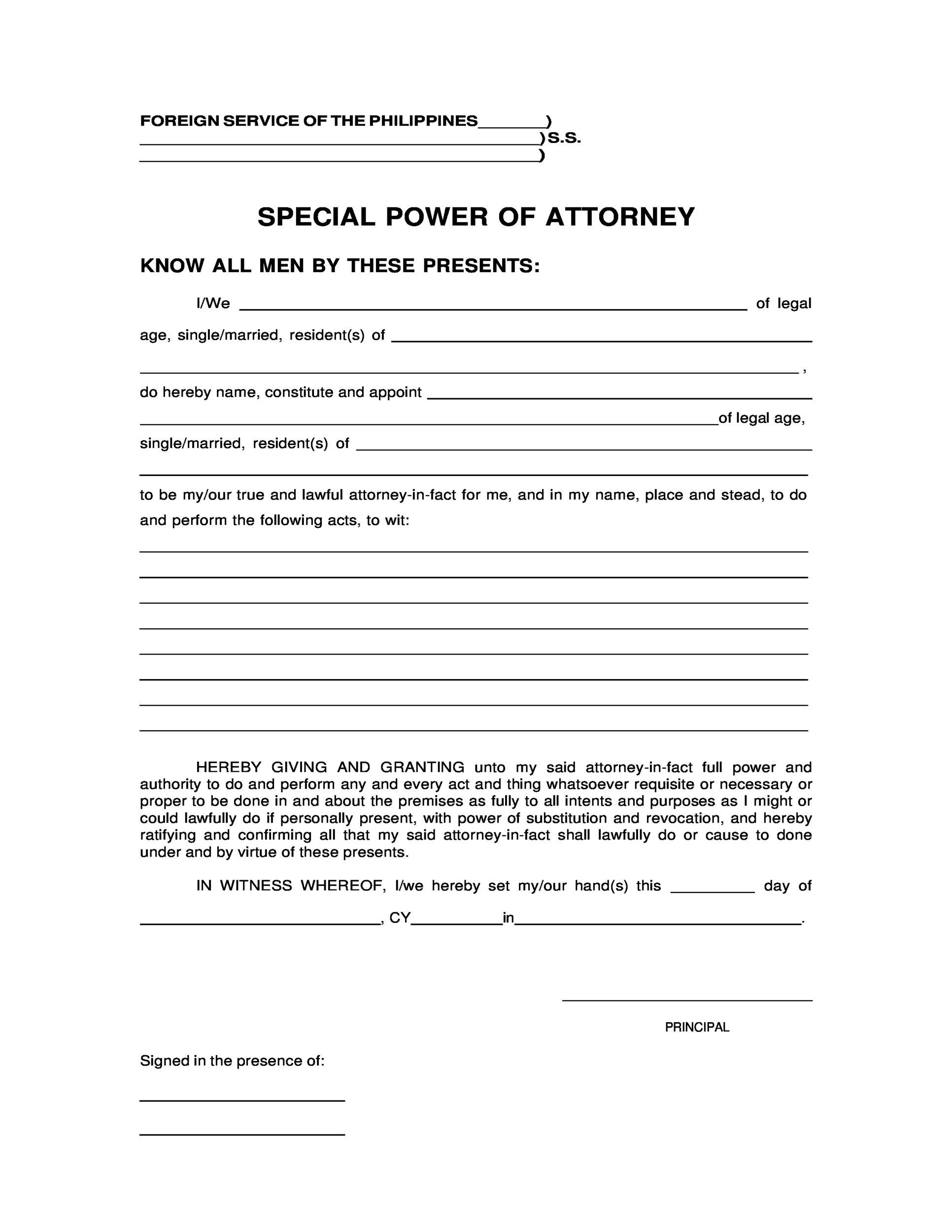

How to get a power of attorney. Serving as a state attorney general is seen as a good launching point for a shot into a state’s governor’s mansion. There are several different types of power of attorney. Each is tailored to meet specific needs and grants varying levels of authority to the agent.

Requirements for power of attorney are similar in most states, but some have special. A power of attorney, or poa, is an estate planning document to appoint an agent to manage your affairs. And the short answer is no, you do not need to hire an attorney to get a poa.

Knowing the distinctions between them is important to ensure your legal and financial security. Download or write a power of attorney form. This may be because you are travelling, or ill, or have had an accident.

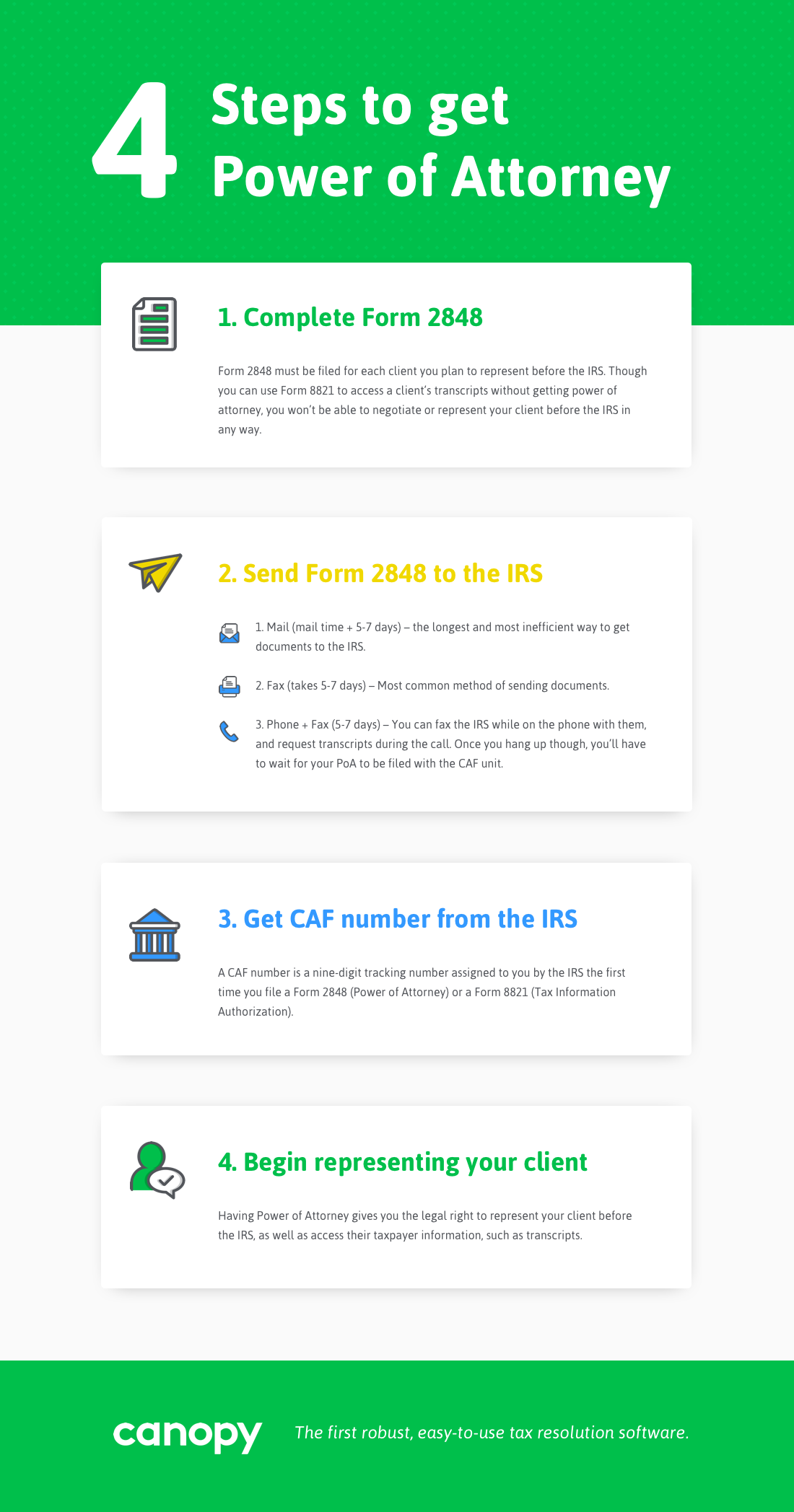

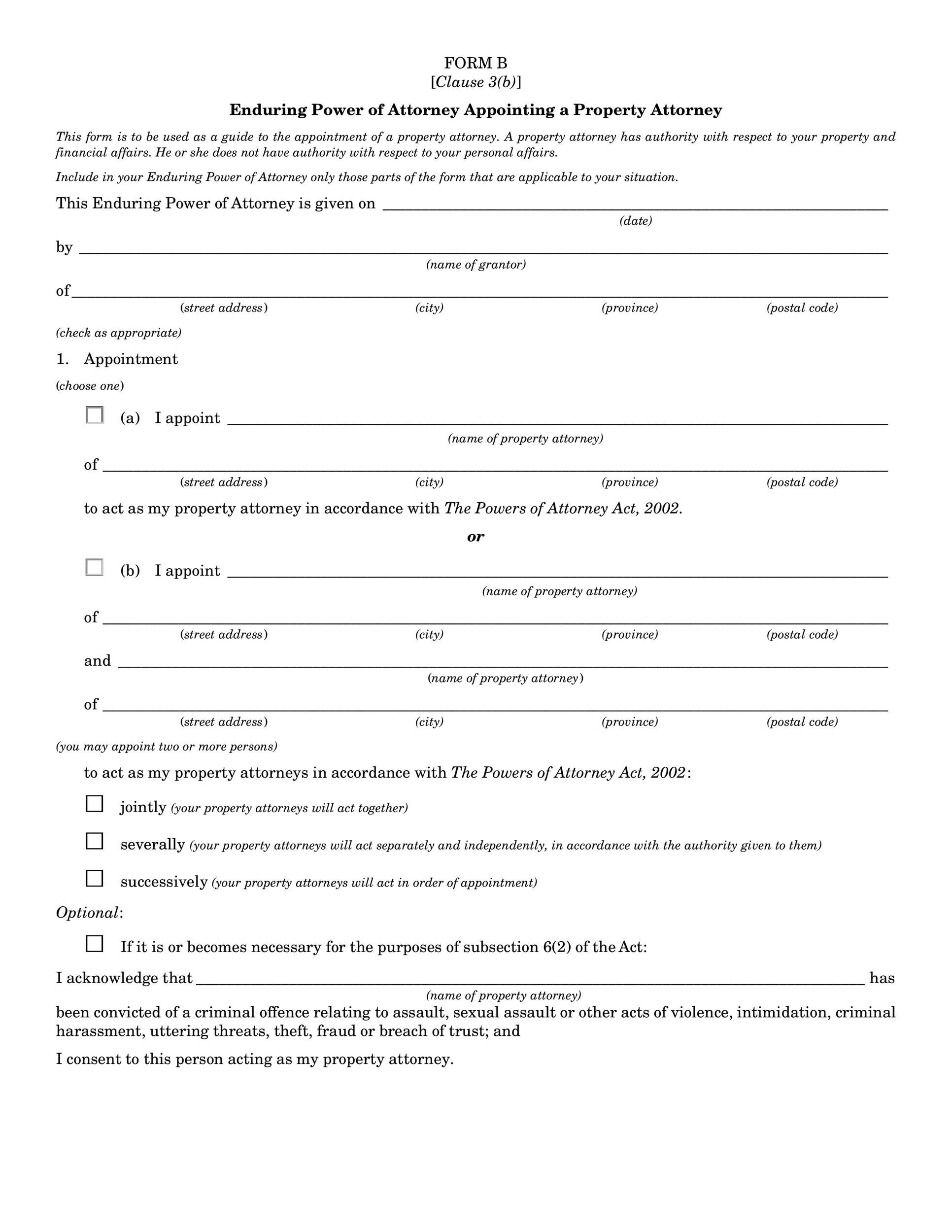

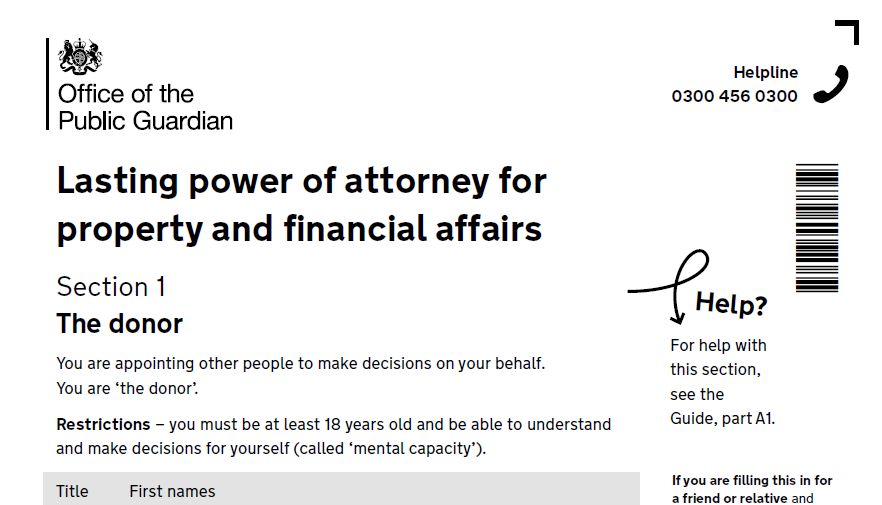

Register your lpa with the office of the public guardian (this can take up to 20 weeks). A power of attorney (“poa”) is a legal document that allows someone (the principal) to give another person (the agent) the legal power to make decisions on the principal’s behalf. You must do the following to set up a power of attorney:

Creating a power of attorney can help your loved ones manage your finances, get and share information, and pay bills for you if you are alive but are incapacitated. Trust & will recommended for you create your estate plan or file for probate today. The power gives your agent control over any assets held in your name alone.

How to make a lasting power of attorney choose your attorney (you can have more than one). Key takeaways types of power of attorney what are the limits of a power of attorney?

However, the only way to get power of attorney is by being named in the document or through a formal court order. A power of attorney is a legal document where you nominate a person or trustee to manage your assets and financial affairs. Moneysavingexpert.com founder martin lewis explains why power of attorney is so important, how to get one and more in the latest episode of itv's the martin lewis money show live.

It’s essential to ensure you choose the right type of poa to meet your needs. The video clip and the transcript are below, but you can also see our power. Consider durable power of attorney.

You specify in the legal document what authority you are transferring to. Types of power of attorney. Obtaining power of attorney 1.

A financial power of attorney is a legal document that allows a trusted person to manage your money if you no longer want to, or are unable to. The power may give temporary or permanent authority to act on your behalf. Check your document for clarity.

![Washington Power of Attorney Templates (Free) [Word, PDF & ODT]](https://templates.legal/wp-content/uploads/2021/03/Washington-Minor-Child-Power-of-Attorney-Templates.Legal_.jpg)