Recommendation Info About How To Claim Overpaid Income Tax

For example, the normal time limit for claiming overpaid income tax or.

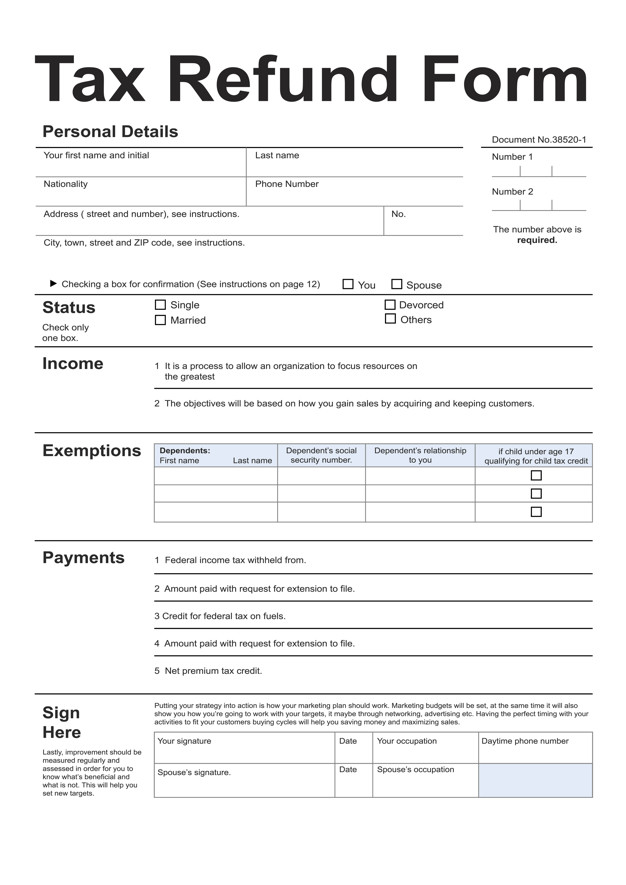

How to claim overpaid income tax. However, if you do not claim a refund within 45 days, hmrc will send you a cheque. You can also use this form to authorise a representative to get the payment on. You can claim a tax refund for up to four years after the end of the tax.

Hmrc form r38, commonly known as the “claim for repayment of income tax” form, is a crucial document provided by her majesty’s revenue and customs. How to get overpaid taxes back when moving out of the uk. To find out more about the hmrc app on gov.uk.

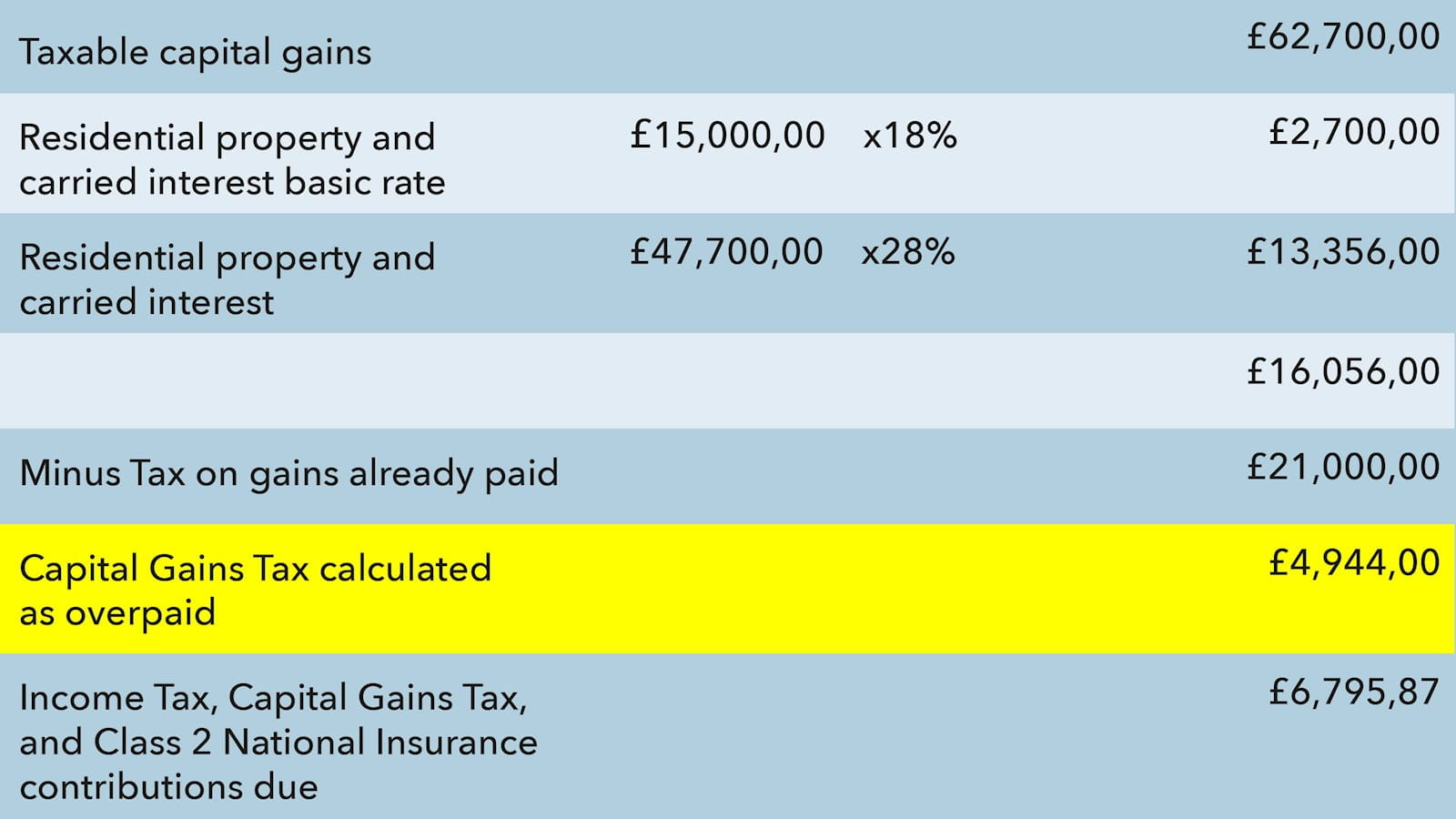

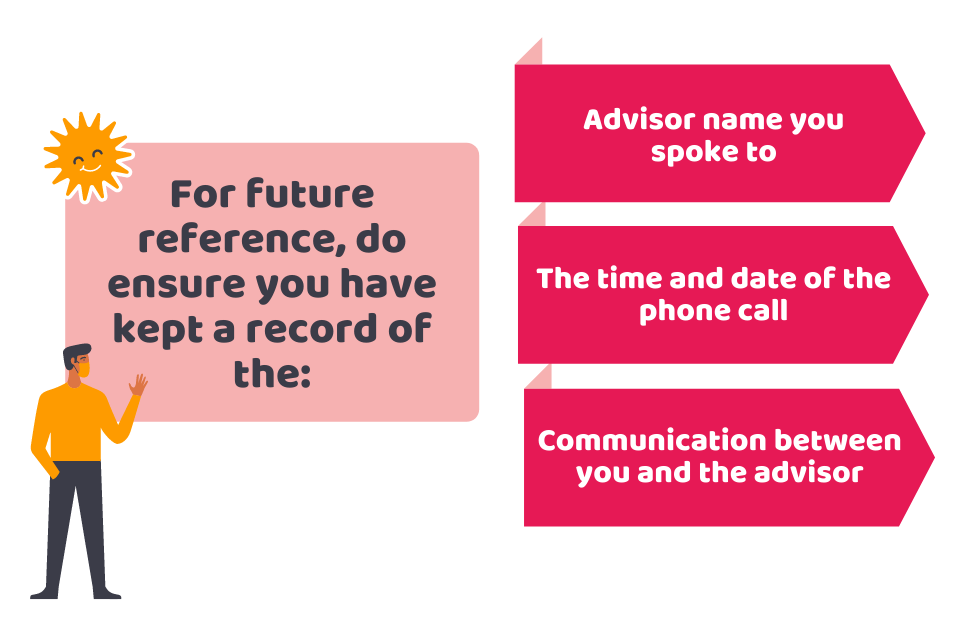

The taxpayer or their agent needs to contact hmrc on 0300 200 3300 to enable the overpaid tax to be repaid. The tax system is full of time limits, so taxpayers and their advisers need to be constantly on their guard. There are at least ten situations.

This video looks at how you can view, manage and update details and claim a tax refund using the hmrc app. You will be eligible if you have overpaid any tax or have yet to claim some tax refunds, like a uniform tax refund. When can you claim lhdn tax refund, how long does it take for lhdn to refund?

The letters are sent out between june and the end of november. If you’ve paid too much income tax on a flexibly accessed pension payment you can claim a refund if all of the following apply: To get a refund on any overpaid taxes, you can claim in arrears of up to four years and notify hmrc of your allowance in advance to update your tax code for future.

For those that need tax rebates, you can claim a tax refund directly on the hmrc website. You can submit a claim for a refund of any. You have to inform hmrc why you think you have overpaid tax before the end of the tax year.

You have till this spring to claim any 2020 tax money the irs is holding. You can also claim a refund via your personal tax account if you have paid too. How to claim overpaid tax from hmrc for the current tax year?

You’ve flexibly accessed your pension. If you receive more than this from your pension and any employment income combined, you’ll pay at least 20% basic. If you’ve overpaid taxes due to mistakes made when filing your tax return, you need to amend your return before you can claim back the money.

Online tax software can help you complete your tax return to claim a tax refund for 2021 (you. Thousands of pensioners have claimed back more than £10,000 from the taxman after they were emergency taxed on retirement income, new hmrc data shows.