Lessons I Learned From Info About How To Claim Old Age Pension

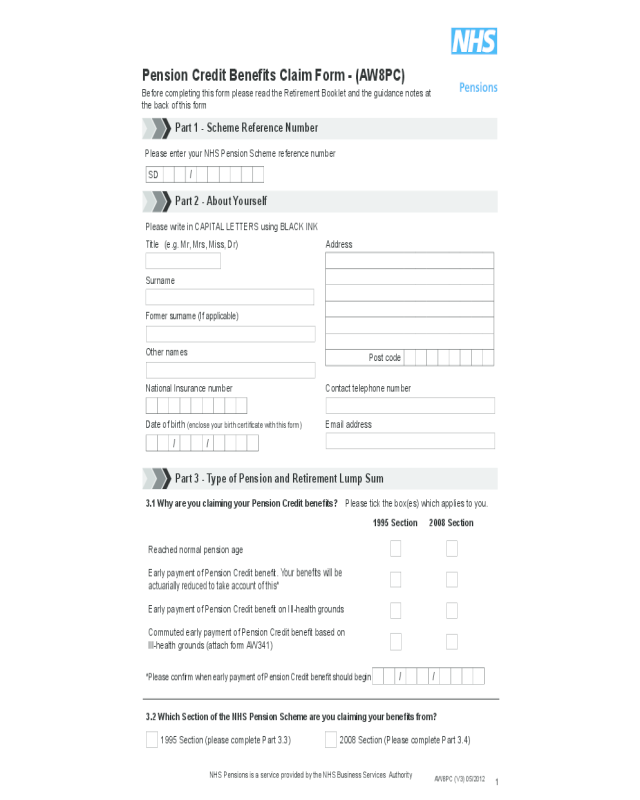

![[PDF] Old Age Pension Application Form Delhi PDF Download in Hindi](https://www.formsbirds.com/formimg/pension-application-form/1399/claim-for-age-pension-and-pension-bonus-l21.png)

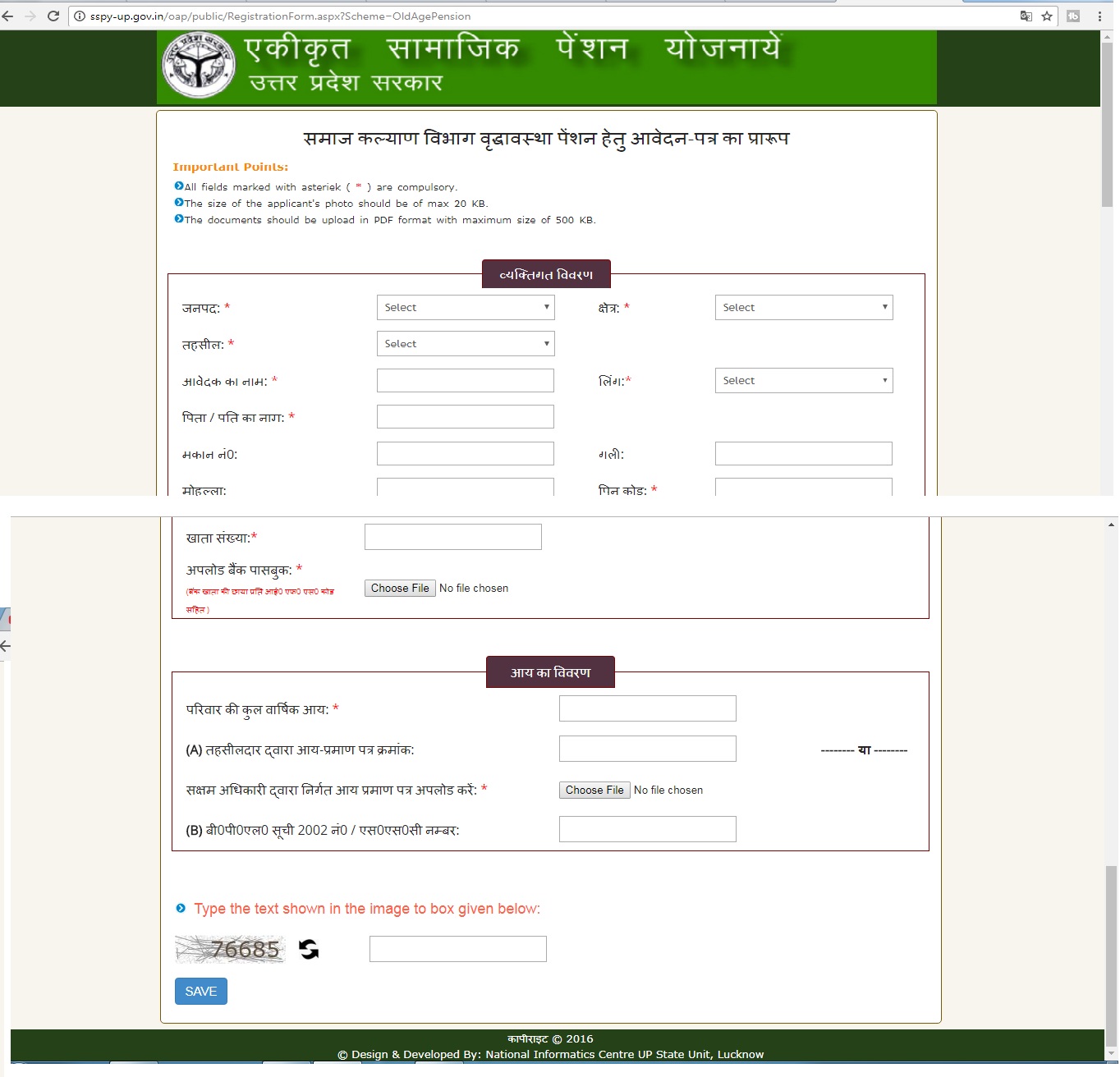

Before you start you should decide how you want to claim.

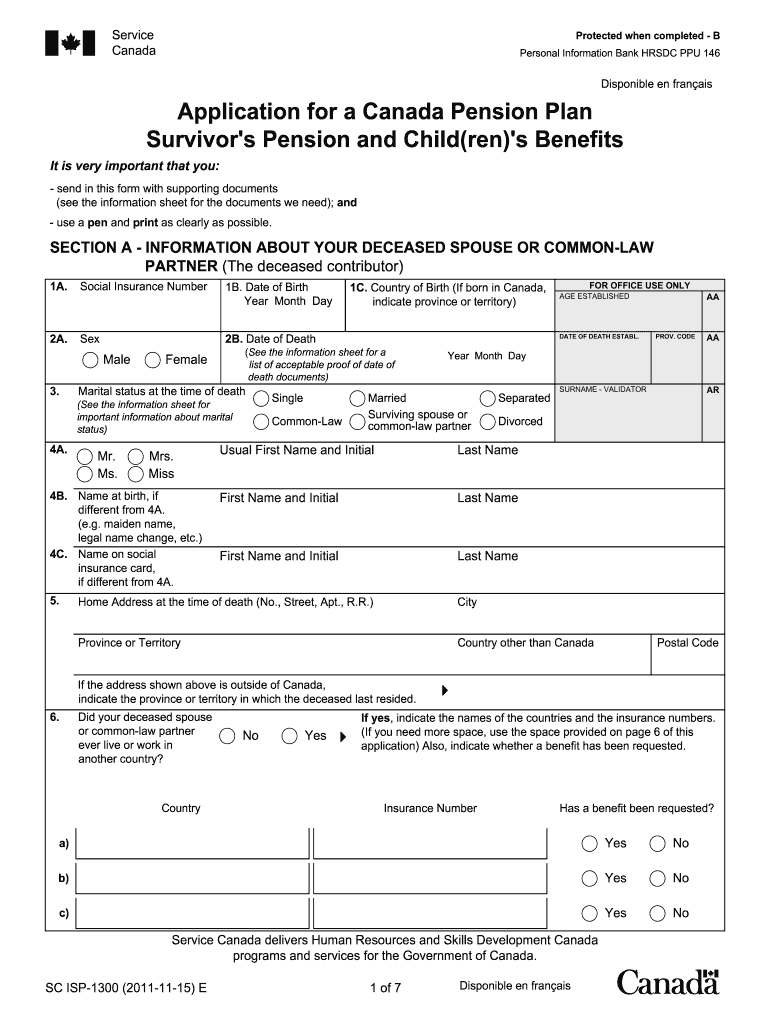

How to claim old age pension. You can claim by phone if you reach state pension age in the next 4 months. Under the income and assets test. Proof of employment from the employer proof of physically returning to canada (unless you turned 65 while still employed outside.

To get this you must be all of the following: The state pension is a regular payment from the government most people can claim when they reach state pension age. Check your state pension forecast.

Canada.ca benefits old age security the old age security (oas) pension is a monthly payment you can get if you are 65 and older. You also need to be either. There are a few options for claiming age pension.

If you were born between 1943 and 1954, your full retirement age is 66. Find out more about old age security pension recovery tax. Be at least 1 month past your 64th birthday not be currently receiving an old age security pension have not already.

On this page online paper form staff assisted online it’s easy to. However, social security agreements may help you claim if you’re living or have lived. You can claim the new state pension when you reach state pension age if you have at least 10 years of national insurance contributions and are:

You can check when you'll receive your state pension using the gov.uk checker below. A man born on or after 6 april. Your state pension age depends on when you were.

You usually need to be an australian resident and in australia to claim age pension. If you want to claim by post, phone the pension service to get a state pension claim form sent to you. How much you could get and when.

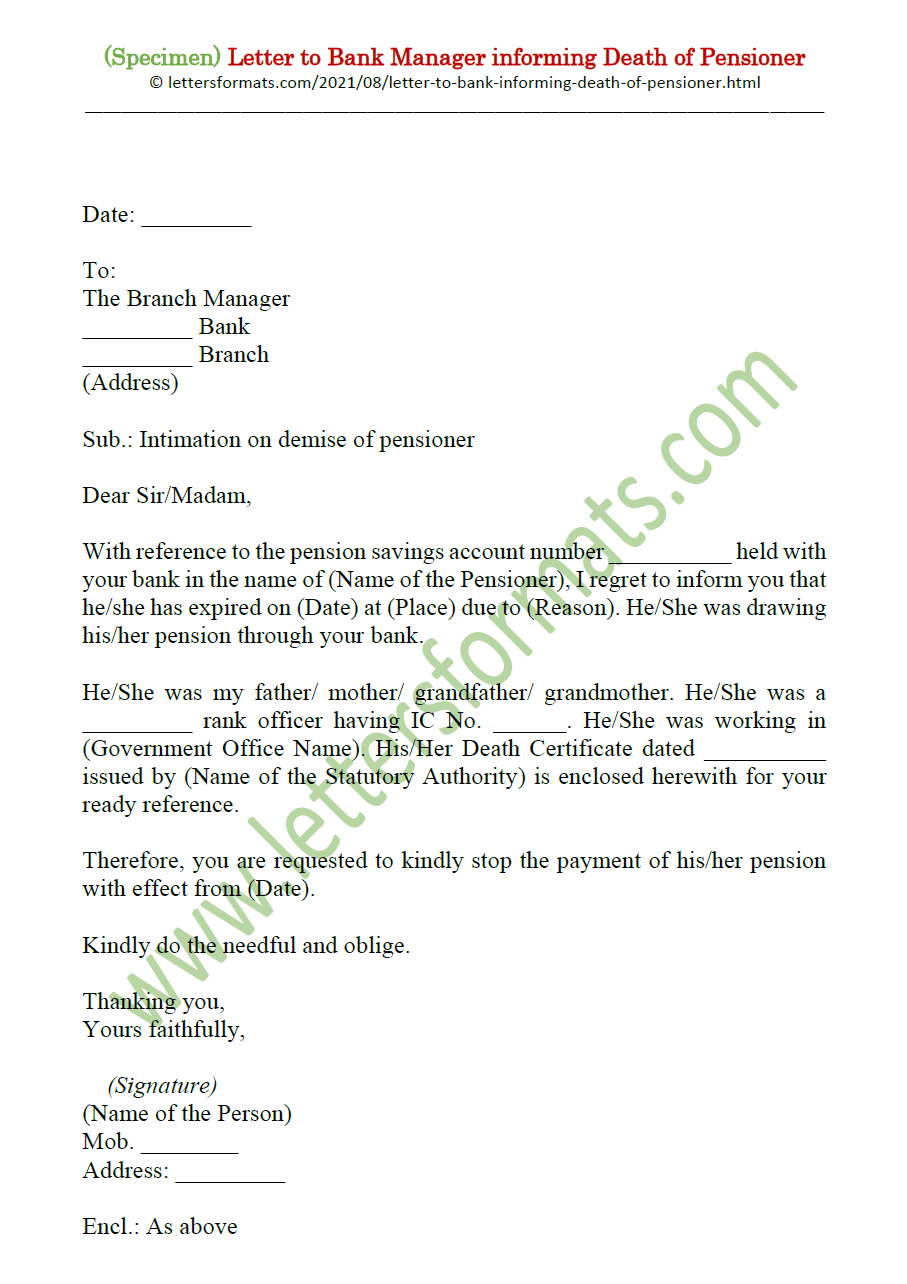

Government that most people can claim when they reach state pension age. When can i claim my state. You must provide the following 2 documents:

Check your state pension age. How to find your social security full retirement age. If you’re legally blind and you’re not claiming rent assistance, you may be able to claim age pension without being assessed against the income and assets tests.

It’s based on your national insurance (ni) contributions and credits. If your income is higher than $81,761 (2022), you will have to repay part or your entire old age security pension. The main income support payment for people who have reached age pension age.

![[PDF] Old Age Pension Application Form Delhi PDF Download in Hindi](https://instapdf.in/wp-content/uploads/pdf-thumbnails/oldageform2-pdf-760.jpg)