Formidable Tips About How To Claim Emergency Tax Back

For refunds of emergency taxfrom a previous year, you must submit an income tax return for that year.

How to claim emergency tax back. Firstly, if your p800 shows you’re. You can get back overpayments caused by an emergency tax code in various ways. Thousands of pensioners have claimed back more than £10,000 from the taxman after they were emergency taxed on retirement income, new hmrc data shows.

Of those, 2,300 retirees were hit with emergency. It's worth noting that revenue changed the rules. I was on pandemic unemployment payment (pup);

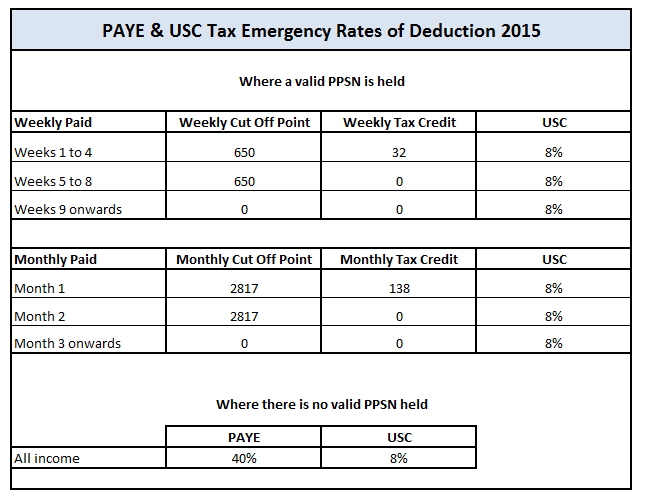

How can you claim back emergency tax? How to claim back emergency tax last reviewed: After the first 4 weeks, if your job is still unregistered, your entire income will be taxed at.

Sign in to myaccount and select ‘claim unemployment repayment’ on the paye services card. It is important to make sure that your taxes are handled right from the start and that your new employer deducts the correct amount of tax from your pay. How do i get a refund?

And international, federal, state, or local. When is emergency taxation applied? Taxpayers can deduct medical expenses by itemizing them on their taxes.

What rate is emergency tax? The quickest and easiest way to claim a refund is by using our online service myaccountto complete an income tax return. The irs today announced that taxpayers in california affected by severe storms and flooding that began on january 21, 2024, now have until june 17, 2024, to file.

Your employer is obliged to operate. To claim a refund: Your income is taxed at the standard rate (20%) until week 4.

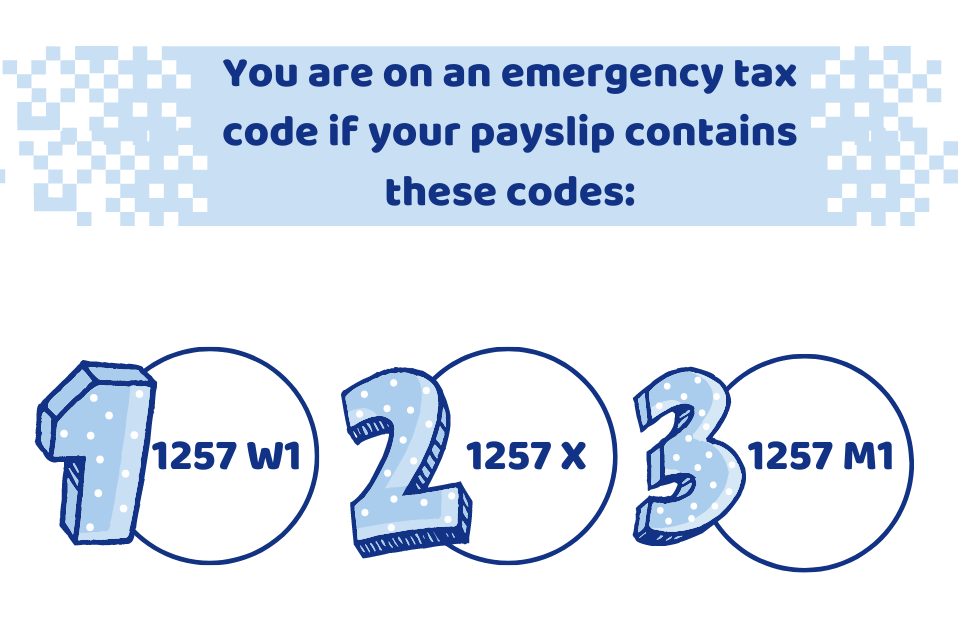

1 claiming emergency tax back is easy credit: If you've given your employer your pps number, you'll be taxed under normal emergency tax rules meaning you're allowed a single person's rate band for the first 4. You must verify the figures on your.

Five medical expenses you can deduct on your taxes. You should receive a p800 tax calculation via mail explaining why hmrc deducted excess tax due to your emergency code. Revenue will then send your tax credit information to your employer who will then refund you the overpaid tax in the next payroll.

February 2024 as of the 6th january 2024 the main rate of class 1 national insurance contributions (nic) deducted from. Alamy however, if you do not have things in working order, you will be hit by it. Use this tool to find out what you need to do if you’ve paid too much tax on different types of income, such as a job, a pension, a self assessment tax return or a redundancy.

![[SOLVED] HOW TO CLAIM EMERGENCY TAX BACK IRELAND? YouTube](https://i.ytimg.com/vi/Nqd8Cyg-BOY/maxresdefault.jpg)